To view the full print/pdf version of 2025's issue 4 of Currents, click here

For previous issues of Currents, visit our Currents Library

This Year, Next Year, & Beyond

By: Chris Reese, President & CEO

Email: contacttheceo@sussexrec.com

Sussex REC, like many utilities, is under pressure as 2026 approaches. Our costs are rising, stemming from shifting government policies, supply-demand imbalances, and inflation.

Conflicting federal and state energy policies have shaped today’s grid challenges, a topic that’s been constantly highlighted in New Jersey’s political campaigns this year. Ever-changing government policies have strongly affected these supply and demand swings. Steve Brame, CEO of our power provider Allegheny Electric Cooperative, in my video interview with him for our 2025 Online Meeting called this the “windshield wiper effect” of short-lived public policy.

Power supply is struggling to meet higher demands due to early closure of coal and nuclear plants and surging requests for more power from data centers. I keep coming back to the basic law of supply and demand. If we constrict power supply, perhaps unnecessarily, while the demand for power increases unchecked, we are naturally going to be faced with very high prices.

In 2024, PJM market capacity prices surged 833% (!) due to high demand and limited supply, impacting New Jersey consumers. Sussex REC members thankfully are somewhat insulated from the worst of this surge thanks to co-op ownership of generation assets, including the Susquehanna nuclear plant and Raystown hydropower plant. Only 33% of our supplied power is market dependent, so there is some impact on us, but not as large as the impact on the rest of the state’s population whose utilities do not own their own generation.

In 2024, PJM market capacity prices surged 833% (!) due to high demand and limited supply, impacting New Jersey consumers. Sussex REC members thankfully are somewhat insulated from the worst of this surge thanks to co-op ownership of generation assets, including the Susquehanna nuclear plant and Raystown hydropower plant. Only 33% of our supplied power is market dependent, so there is some impact on us, but not as large as the impact on the rest of the state’s population whose utilities do not own their own generation.

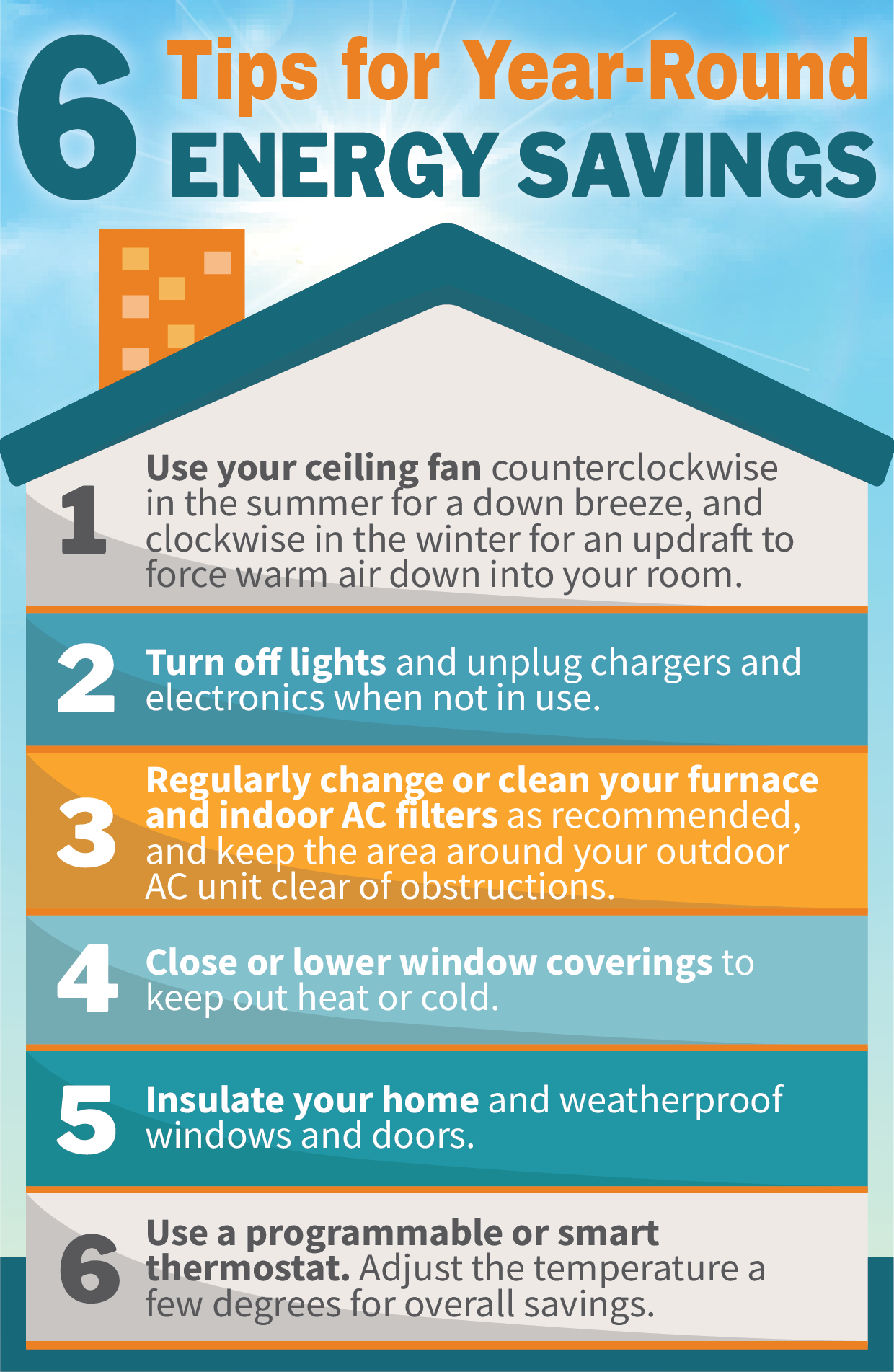

Transmission costs from Allegheny will also increase in 2026. This is the cost to move power across the region from the power plants to our delivery points. This will primarily affect the energy portion of our members’ bills (kWh usage). Members can at least attempt to manage this by reducing consumption where possible.

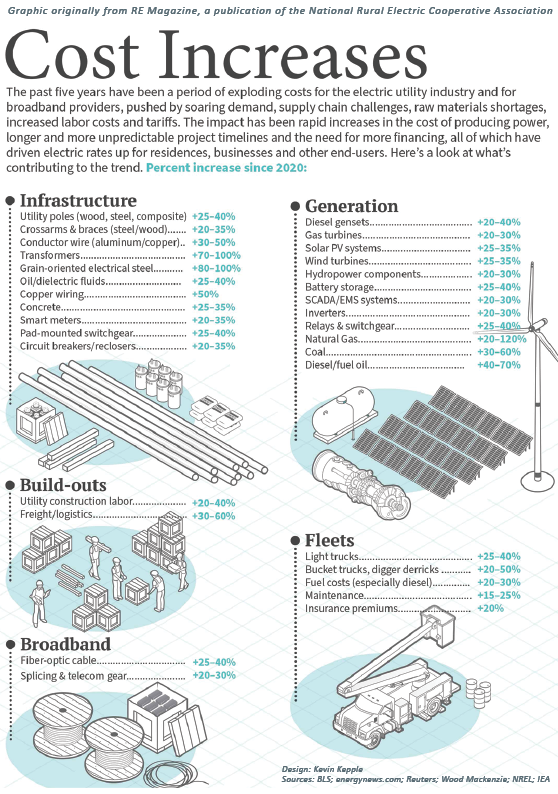

The co-op’s resilience stems from ongoing system upgrades and investments we’ve made in technologies like AMI and FLISR (highlighted in the main article of our last issue of Currents). Members had their power on and available an average of 8,756 out of the 8,760 hours last year, and our time to restore power when we do have an outage is consistently low. But inflation and other economic factors have driven up equipment costs, too. Key materials such as transformers, poles, and wire now cost 40–100% more than they did just a few years ago (see the chart below). These are purchases that we cannot avoid, as we have to have inventory on-hand for regular maintenance and also for restoration from severe storms.

At time of writing (in late October), we are still working on finalizing the details of 2026’s rate adjustment. As we get closer to the new year, you can expect more information to find its way to you through announcements on our website, social media pages, opt-in email alert service, and the communications box on the bottom portion of your electric bill.

As market forces push costs higher, we are trying to hold the line and keep your rates as fair, and low, as possible. “Possible” is the key word here, as we don’t have full control over all of the increases I have described above.

I think most of you know this: as a cooperative, we run our operations “at cost.” We are not in business to turn profits and dividends for investors. We only charge what we forecast we’ll need to provide safe, reliable, and always-on power. But our rates still must, among other things, cover the cost of supplied power, the cost of materials and equipment, the management of the decimated ash trees constantly threatening our lines, and also must ensure we have the necessary staffing – the best employees out there – working to fulfill our mission for our members. If the year goes well and we end with a margin, know that 100% of it will be returned to you via capital credits.

This may be a lot to digest, but our goal is to provide you with as much up-to-date information and be as transparent about our rates as we can. The value of the co-op model for an electric utility has never been more evident. While tomorrow seems challenging, the possibilities are promising. With all that I just stated, we still anticipate having one of the lowest electric rates in the state next year. With only four small town systems that are lower, SREC’s residential electric rates are lower than 99% of the state’s population – by anywhere from 6% to more than 40%!

This is something that I am very proud of and that goes along with our 88-year-old mission: to keep the lights on while keeping rates as low as possible. We are supplying our members with 80% carbon-free power, with an average of 99.95% up-time and one of the lowest electric rates in the state. Sussex REC is doing its best to achieve its mission, this year, next year, and beyond.

Key Terms of the Energy Market |

To help you keep up with the conversation around the state of the energy market, here is an intro to some key terms. |

|---|---|

AI Data Center |

A warehouse which stores computer systems for training or operating AI. An individual data center takes a lot of electricity to function, exponentially more than the required load of a residential home. This has led to increased demand for electricity as these facilities spread throughout the U.S. |

BPU |

The Board of Public Utilities, a state agency which oversees utilities in NJ. As a co-op, Sussex REC is not governed by the BPU, but we work to comply with all BPU guidelines. |

IOUs |

Investor-owned utilities, operating with a for-profit business model. In NJ, they are governed by the BPU and buy energy on the open market. |

PJM |

The independent, nonprofit regional transmission organization which coordinates the movement of electricity in 13 states, including NJ. PJM forecasts long-term demand for electricity and available supply. PJM also holds a capacity auction to ensure that available supply of electricity can meet future demand, which relates to market costs for power. |

Open Market |

The market in which wholesale electricity is available for purchase by utilities to meet demand from their consumers. Increased demand and limited supply has caused prices for this power to rise. IOUs in NJ rely entirely on the open market for their electricity due to state laws. |

Transmission Costs |

The amount of money required to transport energy long distances from where it is generated to the consumer at the end of the line. These costs have been rising due to many factors. |

Up-Time |

The amount of time in a given period that power is available to consumers. |